Summary

The value of the Index Coop community treasury currently stands at $16.5M, made up of $16.2M INDEX tokens (98.46%) and $254k DPI (1.54%). DPI streaming fees have been growing at over 100% per month and accruing value for INDEX holders. The community expects the strong revenue growth to continue into the future, reflecting ongoing widespread adoption of our flagship DPI product and strong interest surrounding the recently launched CGI product. Key takeaways include:

CGI launched 22nd February of 2021 (Introduction article and podcast discussion)

DPI progressing towards being listed on centralised exchanges (watch this space)

Index Coop remains well funded with a further 1.53M INDEX tokens becoming available between now and October 2021. The 1 year vesting contract started with a balance of 2.38M INDEX tokens and has been drawn down periodically as tokens are made available. The table below details the remaining balance held within the 1 year vesting contract. Further information on the vesting contract can be found here. At today’s pricing, the remaining balance in the 1 year vesting contract is worth $24.8M. These funds, once transferred to the treasury, will be used to fund growth initiatives, governance mining, incentivising liquidity and rewarding contributors. Liquidity mining incentives to date include:

UniSwap DPI-ETH liquidity mining

Loopring DPI-ETH liquidity mining

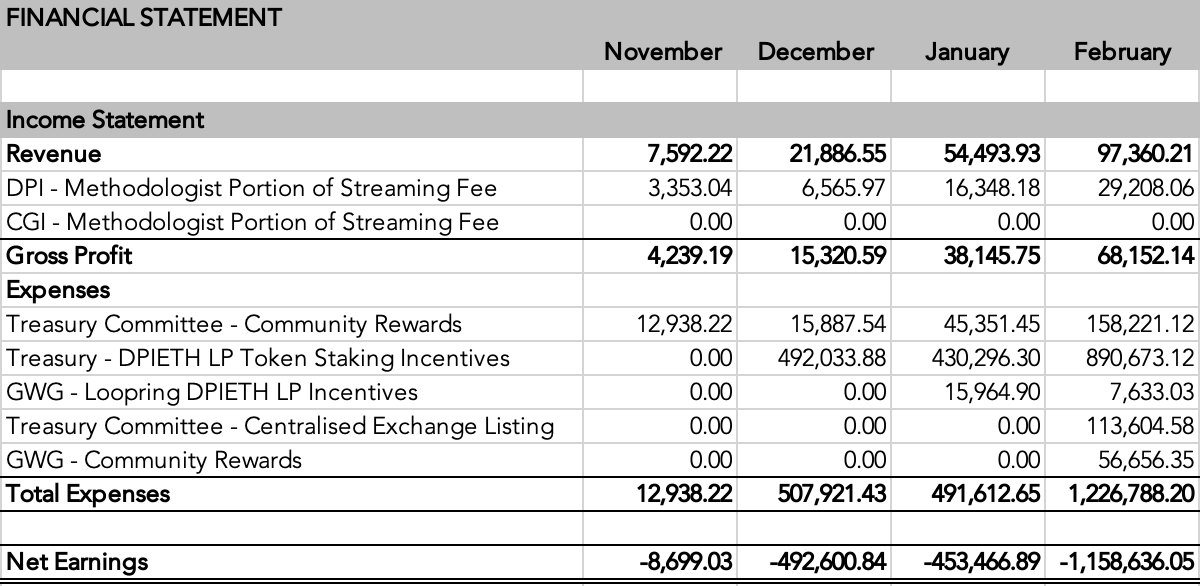

Income Statement

Until recently, Index Coop’s flagship product DPI had been the sole source of Revenue for Index Coop, this changed with the launch of CGI on the 22nd of February 2021. Revenue is total fees generated and Gross Profit is Index Coop’s portion of the revenue. Revenue generated from the 0.95% DPI streaming fee has been growing at a rate of nearly 100% per month, and with the introduction of CGI, Index Coop expects the strong growth to continue. Based on the February 2021 revenue figures, DPI is generating annualised revenue in excess of $1M. The 0.95% DPI streaming fee is split 70/30 with DeFi Pulse and Index Coop’s 70% share is shown as Gross Profit in the below Income Statement.

The Income Statement below is presented in USD and records the USD value of each transaction at the time each transaction occurred. For instance, if INDEX tokens are transferred from the treasury to a merkle contract for distribution to contributors, the USD value of the transfer to the merkle contract is recorded. The tokens are priced using the CoinGecko USD opening price on the day the transaction occurs.

Index Coop launched on 6th October of 2020 and the first, non genesis, payment to contributors was made in November of 2020. Since then, the community has undergone transformational growth, onboarding many contributors, offering many bounties and distributing INDEX tokens to those that provided liquidity for DPI within the ecosystem.

* Note: APY fluctuates based on the number of deposited tokens in the contract and the price of the INDEX tokens.

DPI-ETH LP liquidity mining incentives make up the large majority of Index Coop capital outflows. This is reflective of the steadily declining INDEX token allocation being offset by a rather large increase in the price of the token. On the 6th December of 2020, INDEX was priced at $4.22 and the 115,920 tokens sent to the staking contract were worth $492,033.88. By the February 7th of 2021, INDEX was trading at $23.75 and the 37,500 tokens sent to the staking contract were worth $890,673.12 at the time. Although INDEX incentives fell from 3,864 per day (115,920 over 30 days) to 1,250 per day (37,500 over 30 days), the price of each token increased from $4.22 to $23.75. The overall APY on the staking contract is currently around 17%.

Exchange listings and Partnerships

Fiat based centralised exchanges remain an important access point to crypto for many token holders. The Index Coop community is pursuing listings on multiple centralised exchanges. We expect our initial listings to be complete by the end of March. Our strategy focuses primarily on listings with mid-size exchanges that have strong international user bases. Onboarding new users through fiat on-ramps remains a core strategic priority for our community. We anticipate additional listings to be a major revenue driver for Index Coop over the next quarter.

Our community continues to develop partnerships with major DeFi protocols. These partnerships span a broad range of activities including trading competitions, yield farming, and liquidity pooling. As our partnerships continue to develop we expect them to drive user engagement and significantly increase our assets under management.

Product Performance - DPI

In this section we will look at the performance of DPI in relation to our competitor’s top products. We compare each product on various metrics and also take a look at the fees generated to the founding community. Comparison measures include:

Assets Under Management

Liquidity within ethereum ecosystem

Daily Trading Volume

Annualised Product Fees

Currently, DPI dominates the space in all metrics. The chart below shows DPI’s assets under management (AUM), liquidity and daily trading volume exceed that of our competitors. Indexed Finance’s Crypto10 and DeFi5 are the next best alternatives in terms of 7-day average trading volume coming in around $3.5M and $2.7M respectively when compared to DPI’s $9.3M. This is interesting as the Indexed Finance products recycle swap fees back to the token holders via a 2.5% swap fee Balancer pool. This makes for a lucrative income stream as a liquidity provider but Indexed Finance as a protocol derives no income from it (worth noting their latest index DEGEN will harvest a 0.5% exit fee and direct it towards the protocol treasury). Using a Balancer pool also opens up the risk of having the index purchase a failing token as it’s value drops, in the worst case scenario this could see the index rebalance into a token that goes to 0 or close to it.

The common thread between the two charts is that there is a clear distinction between small (Powerpool & PieDAO), medium (Indexed Finance) and large cap (DPI) products. Clearly products with high liquidity generate more trading activity, but the important outliers are the products which outperform in terms of fees generated relative to trading volume.

Decentralisation

After launching Index Coop 5 months ago, we are now ready to start publishing data showing INDEX token distribution across the ecosystem. For this initial review, we used unique user address data from etherscan and excluded vested contracts, liquidity pools and unclaimed rewards to focus on the tokens readily available to vote.

To reach consensus on a vote, two criteria must be met. There must be a minimum 15% participation rate and, of those that participate, 60% must vote in favour of passing the proposal. The 15% participation requirement is shown below as the grey line. The 60% vote in favour of the proposal is shown as the yellow line below. It is clear from the below chart, there is a concentration of holders who have the ability to significantly influence the outcome of any vote. Although no one voter can reach the participation requirement, any collusion within the top few holders represents a risk to the DAO.

* Note: This chart excludes all tokens currently in vested contracts and those within liquidity pools. That data is from 22nd February of 2021.

The table below details the Top 10 INDEX token holders and captures all the large holders clearly seen in the chart above. Looking forward, there are numerous proposals being discussed around this topic. Some include governance mining which includes delegated voting, and the contributor token ownership plan which discusses ways to increase decentralisation and community ownership. With the introduction of delegated voting, INDEX token holders would be able to pool together with a chosen politician/representing the pool. Voting will also be incentivised with INDEX tokens. The main goals here are to incentivise and improve voter engagement, while allowing those who don’t have time or prefer to delegate to remain undiluted by the reward distribution.

Inflation Schedule

As of the end of February of 2021, the community treasury has received a total of 1,489,583 tokens from a combination of the initial 500,000 seeded at launch, plus the 989,583 vested from the year 1 treasury. Emissions will continue to be vested at 197,917 per month until October when the vesting rate slows to 118,750 per month to years end.

The below table details the quantity of INDEX tokens withdrawn from vested contracts and the initial treasury deposits from the genesis contract. Details on the initial INDEX token distribution can be found here.