An introductory series

Two weeks ago, we announced the inception of the Investment Committee and the rebranding of the Index Coop Newsletter to Index Coop Insights. As outlined in our post, the aim of the Committee is to create educational resources and investment insights.

We are kicking off this initiative with an introductory series on the underlying DeFi Pulse Index tokens. Over the coming weeks, we will publish articles analyzing protocols within the DeFi Pulse portfolio and explaining them in a simple way. We are starting with an introduction to Compound Finance, the first DeFi killer Dapp.

For more information and to get involved please visit our:

Discord | Twitter | Reddit | LinkedIn | Website | Medium

Compound - Protocol Overview

Compound is a protocol on the Ethereum blockchain that allows users to borrow and lend crypto tokens. Interest rates are set algorithmically based on the supply and demand for each asset. Lenders and borrowers interact directly with the protocol, earning (and paying) a floating interest rate, without having to negotiate terms such as maturity, interest rate, or collateral with a peer or a counterparty.

The protocol was founded in 2018, raising $8.2M in a seed round and an additional $25M in a Series A round in November of 2019. The list of early investors reads like a who’s who of blockchain VC’s, including industry giants like Andressen Horowitz, Polychain Capital, Coinbase Ventures and Bain Capital Ventures.

At the time of writing, Compound is among the top three DeFi protocols measured by total value locked (TVL). An exponential growth of value locked in 2020 (growing from $15M at the beginning of the year to over $1.9bn by the end of 2020, ) reflects confidence and trust in the protocol. This strong growth was supported by liquidity mining incentives which, in our opinion, doesn't take much away from Compound's achievement.

History - Becoming a Main Pillar in DeFi

While Maker DAO can be credited as the first project allowing users to take out loans, Compound was the first DeFi project to offer permissionless lending pools, whereby users can earn an interest rate on their deposits. The v2 whitepaper was published by founder/CEO Robert Leshner and co-founder/CTO Geoffrey Hayes in February 2019. Compound quickly became one of the main pillars of DeFi. In the beginning, the protocol supported six tokens (Ether, 0x, Augur, Basic Attention Token, Dai and USDC).

Since then, a few additional tokens have been added (and some deprecated) to the market. The project team as well as the Compound community has kept innovating. Although already very popular with many active Ethereum users, the protocol really entered the spotlight when they announced that they would be rewarding their users with the protocol’s own governance token COMP.

What started out as a measure to increase decentralization became a key moment for the entire Ethereum ecosystem, triggering what is now known as DeFi summer 2020. Over the next three months, countless projects adopted a similar approach, rewarding their users with different tokens, leading to a chase for the highest yields among new entrants, coining the term yield farming.

Lending - The Purpose of cTokens

Lending an asset to the compound protocol results in two transactions. The first is a deposit of the original token (e.g. Dai) to the protocol. The second is an automated crediting of cTokens (cDai) to the wallet providing the asset. The newly minted c-version works as an IOU (I owe you) and acts as a redemption token, permitting the holder to redeem the original token. The value of a cToken is determined by Compound through an exchange rate, which is designed to increase in value over time.

By holding cTokens, the owner earns interest through the cToken’s increasing value compared to its original counterpart. Hence, when cashing out the cTokens (i.e. redemption), the user will receive more of the actual underlying token than originally deposited. Borrowers, on the other hand, ensure that there are more tokens to be paid to lenders by always paying a higher interest rate when borrowing an asset. The actual rate is determined by supply and demand (utilization), but more on that later.

Borrowing - Over Collateralized Loans

Borrowing tokens on Compound works in a similar way to minting Dai on Maker. However, in comparison to Maker, Compound requires the user to deposit cTokens as collateral. As with lending, there are no terms to negotiate, maturity dates, or funding periods to borrow assets. In order to mitigate default risk, Compound uses over-collateralization to limit how much can be borrowed.

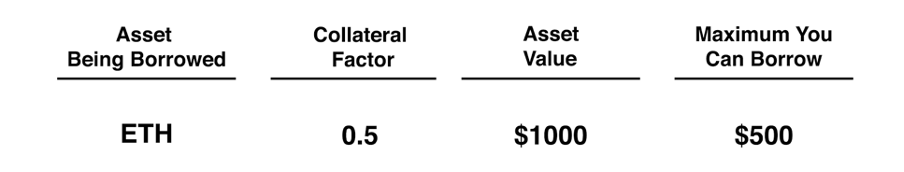

The amount a user can borrow is determined by a collateral factor that can range from 0 to 1. A collateral factor (CF) of 0.7 is equal to 70% of the value of the underlying asset that a user can borrow. Below is an example, illustrating how much a user can borrow with a CF of 0.5.

The interest rate for each token is again determined algorithmically according to supply and demand (utilization).

If the borrowed amount exceeds the capacity a user can borrow, a portion of the outstanding loan may be repaid in exchange for the user’s cToken collateral. Such a liquidation can occur either when the value of the collateral falls below the minimum required, or when the value of the borrowed token rises above the maximum a user can borrow.

Risks vs Incentives

Besides the smart contract risks (i.e. a hacker exploiting frail smart contracts) one risk associated with money markets like Compound is that in the case of a bank run, the platform could run out of liquidity and not satisfy all withdrawals. To mitigate this, Compound bases its interest rate upon the “utilization rate”, that defines how much of lenders’ assets go out to borrowers (see black line in the picture below). For example, if 80% of all available assets are borrowed, the utilization rate is 75%. In consequence, only 20% of lenders could withdraw their assets at once.

Via the interest rate model Compound can disincentivize lenders from withdrawing, because the interest rate is going to increase when the utilization rate goes up (to incentivize lending) while simultaneously disincentivizing borrowers from borrowing more (as it gets more expensive to borrow). The picture above displays the increase of the borrowing rate (purple) and lending rate (green) with increasing utilization rate.

Whether Compound can stomach a black swan event like a bank run still has to be proven. Simulated stress tests were performed in early 2020 by Gauntlet. Furthermore, Compound did survive black Thursday of March 2020 (when Bitcoin and most other assets fell by more than 40% in one day) rather well compared to other protocols. However, it wasn’t in full DAO mode at that time. An incident closest to a black swan event occurred in November 2020, when the price of stablecoin Dai momentarily spiked to 1.3$ on Coinbase. Compound uses Coinbases’ price feed to determine prices on its markets. As a consequence of the sudden 30% increase, some positions were undercollateralized, which led to more than 80M of collateral being liquidated.

In any case, ensuring high liquidity is fundamentally important for Compound. High interest rates are one way to incentivize liquidity, but Compound went one step further and started incentivizing by rewarding users with the COMP token.

Governance - Handing over the Protocol to the Community

With the launch of the governance token in June 2020, the team behind the project made the first step to decentralize the ownership and management of the protocol. Compound began distributing its governance token to all individuals and applications using the protocol - an equal share of 50/50 distributed between lenders and borrowers. In the beginning, the allocation of tokens was done automatically based on usage of each token. This led to different rewards, depending on which token a user supplied or borrowed. However, with the implementation of proposal #35, this was changed so that the amount is partly fixed (10% for each market) and the rest is variable depending again on usage.

At the time of writing, the daily token distribution is 2,312. This allocation mechanism will go on until the reserves are emptied. It will take approximately four years until the 4,229,949 COMP tokens allocated to the reservoir are distributed. The rest of the 10M capped supply was allocated to the team and founders (22% vested over 4 years), to Compound Lab shareholders (24%) as well as future team members and community treasury (4% and 8%).

This new innovative way of transferring ownership of a start-up to its community has several important implications. The most obvious can be seen in the chart of the TVL displayed at the beginning. Although officially just resembling voting rights, the tokens quickly attracted many new users, leading to explosive growth in both lending and borrowing pools. Similarly, the price of the COMP token is another factor indicating high interest in owning a part of the protocol.

The COMP Token

As stated above, the idea behind COMP is to increase decentralization and the token is a tool to govern the protocol. Governance can be many things, for instance:

adding support for a new asset

changing an asset’s collateral factor

changing a market’s interest rate model

changing other parameters or variables of the protocol

or even compensating users (that were liquidated due to abnormal price feeds)

In essence, protocol governance can be compared to managing a company by community voting, instead of a few managers deciding behind closed doors. To be eligible to create a governance proposal, however, the initiator must either have 1% of all COMP tokens delegated to his/her wallet, or have a minimum of 100 COMP to create an Autonomous Governance Proposal (CAP). An autonomous proposal allows anyone with less than 1% of COMP to deploy a proposal (as a smart contract), that can turn into a formal governance proposal if it gets enough support and reaches the threshold of 100,000 delegated votes. All proposals must be submitted in executable code.

That said, there is currently no other functionality of the COMP token. However, when taking the price and market capitalization into consideration, one could assume that a value capture mechanism benefiting token holders is anticipated. Similar projects like Aave, for instance, already implemented a fee that is collected by the protocol and partially paid out to stakers.

Business Model - Target Audience

While lending has clearly found its product-market-fit (with more than 250k individual wallets lending their assets to Compound), there are still some question marks around the value of the borrowing function. Why would someone want to provide collateral to borrow crypto assets, when you can get “real credit loans” without having to provide ETH or BTC. That borrowing is not for everyone is also underlined by the number of borrowers. Only ~6900 wallets are borrowing assets from Compound. Furthermore, isn’t the main advantage of a loan the fact that one can spend more than he/she actually possesses at a certain point in time? Over-collateralization prevents the most common form of credit as we know it from traditional finance.

Below are some use cases:

Leverage Long / Short cryptos

If a user is bullish on a volatile asset (for instance ETH), he/she can deposit ETH to borrow USDC and buy more ETH, to gain more of the upside. On the other hand, if a user is bearish he/she can deposit a stable asset (e.g. Dai), to borrow a volatile asset (ETH) and sell it. Assuming the price of one ETH at the time of selling is 1000$, if the price falls to 300$, repaying the borrowed ETH only costs 300$, resulting in 700$ profit for the user (minus the interest rate).

Gain more exposure to yield farming and arbitrage

Another common use case is built around borrowing liquidity to use it for arbitrage opportunities, where traders profit from a spread in prices or interest rates.

Besides arbitrage, yield farming also attracts borrowers. A user can deposit ETH, for example, to borrow another asset that has a higher yield elsewhere in the DeFi ecosystem. By lending that asset on another platform a user can keep the difference between the interest rates. However, this is also a main use case for Maker DAO, as the borrowing APY is more or less stable.

Need for liquidity

There are many other situations where a user needs liquidity. Compound lets you conveniently deposit your cryptos (on which you earn interest), to get more liquidity. One example is that of a miner who wants to buy more mining equipment, without having to sell his ETH. He can do so using a loan from Compound. The miner can then repay the loan with his mining rewards, while never losing exposure to ETH.

In summary, although borrowing against collateral might not be something the “average person” would do, many in the DeFi space are using it. This is also shown by the breathtaking total borrowing of more than $2.9bn. Roughly 50% of the value supplied is currently being borrowed. Most of the borrowed assets are stablecoins, i.e. Dai and USDC account for more than 80% of the loans.

A note in our own interest: The Index Coop and Pulse Inc are going to launch the Flexible Leverage Index ($FLI), which aims to automate leveraged exposure to ETH (as described in the first use case above). The $FLI lets users enter a leveraged position without having to manage the liquidation risk or having to go through the whole process on Compound manually. Read more here.

Business Model - Revenue Streams

While many DeFi protocols implemented a fee-based revenue model, Compound has not implemented a fee to generate income yet. However, Compound uses a “reserve factor”, a parameter that controls how much of the borrowing interest for a given asset is routed to that asset's reserve pool. In contrast to a fee that flows into a treasury, the reserve pool is only used to protect lenders against borrower default and liquidation malfunction. For example, a 20% reserve factor means that 20% of the interest that borrowers pay is routed to the reserve pool instead of to lenders.

The reserve factor can be changed by the community via proposals. Theoretically, the use of the funds in the reserve pools can also be changed. If and when Compound implements a fee structure or another approach to generate income remains to be seen.

Conclusion and Outlook

DeFi is moving at an incredible pace and protocols need to innovate without sacrificing reliability. Let’s take a look ahead at what Compound will be doing going forward, in an effort to maintain their status as one of the top projects in DeFi.

In December 2020, Compound announced their plans to build a stand-alone Compound Chain, similar to a cross-chain version of the MakerDAO protocol, with a native stable coin called CASH. The new chain will still be governed by COMP token holders on the Ethereum blockchain. According to the whitepaper, Compound Chain is a proof-of-authority (PoA) network with validators appointed by COMP tokenholders, intended to solve the scaling issue on Ethereum and, at the same time, allow for interoperability with other blockchains like Solana, Polkadot and others. This PoA network could potentially enable central banks - issuing central bank digital currencies (CBDCs) - and exchanges like Coinbase to operate nodes on the Compound Chain.

Although Compound's future prospects seem very promising, there are also some hurdles to overcome. For instance, decentralization efforts is a topic that keeps the Compound community busy. One point of critique that is heard often is the high amount of tokens allocated to the team and early investors (almost 60%). Especially after seeing other successful protocols conducting a much “fairer” ICO - catering more towards the community than towards privileged investors (VCs) - some raised their voice and asked for additional forms of token distribution besides yield farming (which again favors the already wealthy). There are a few proposals and discussions on the forum around rewarding early contributors, conducting airdrops, or adding new ways of distributing COMP.

Furthermore, Compound also to work on its price oracle structure, in order to prevent incidents like the Dai liquidation event from November 2020. Last but not least, it remains to be seen, if and when Compound plans to work out an approach to generate a steady income stream.

Compound currently represents 6.97% of the DeFi Pulse Index ($DPI) portfolio. This article is an introduction to the project and we will continue to cover Aave in-depth going forward. You can learn more about the Index Coop Investment Committee here. Get in touch with your comments and let us know what topics you want us to cover in the future.

Links

Index Coop: https://www.indexcoop.com/

Index Coop Insights: https://www.indexcoop.com/news

DeFi Pulse Index: https://www.indexcoop.com/dpi