Navigating the Volatility with Index Coop

A review of how Index Coop products performed during the market turmoil

Plummeting prices. A wave of liquidations. Widespread panic.

Whether you’re a novice investor or an experienced trader, the market plummet of May 19th 2021 likely caused some fear. This was one of the fastest liquidation events ever recorded in crypto history.

Now, everybody is asking: “Was this the market top or just a bump in the road on the way to the moon?”

In this recap, we'll analyze some of the reactions to the downturn along with how the performance of the Index Coop’s products measured up.

DeFi Holds Up Strong

Whenever there is a strong directional move in the markets, it’s important to consider if the fundamental value proposition has changed. Looking at the on-chain metrics, we can conclude that DeFi protocols performed as expected.

DEX volumes soared during the volatility even as gas prices rocketed higher. Uniswap recorded an all time high of $6.3B in trading volume. Sushiswap had a similar uptick in trading volume, hitting $3B over the same time period.

While we don’t want to see drops like this often, there is no denying that high trading volume equates to higher income for exchanges and liquidity providers alike.

Liquidations within the lending markets prompted much of the trading volume as borrowers were forced to repay their loans. Aave alone recorded a total of 114 liquidations worth $28mm. While liquidations are never fun, the good news is that all of the top lending protocols functioned as intended and experienced no issues (unlike the last time this happened in March 2020).

The impact on lending and borrowing was as expected for these types of events. Both Aave and Maker’s borrowing declined by over $400mm, and Compound, according to their website, had a reduction of ~$1.5B. This accounts for 20% of borrowing volume. The lending side of the book was less affected, however: Compound declined -8% and Aave’s total liquidity dropped from $20B to $17.7B.

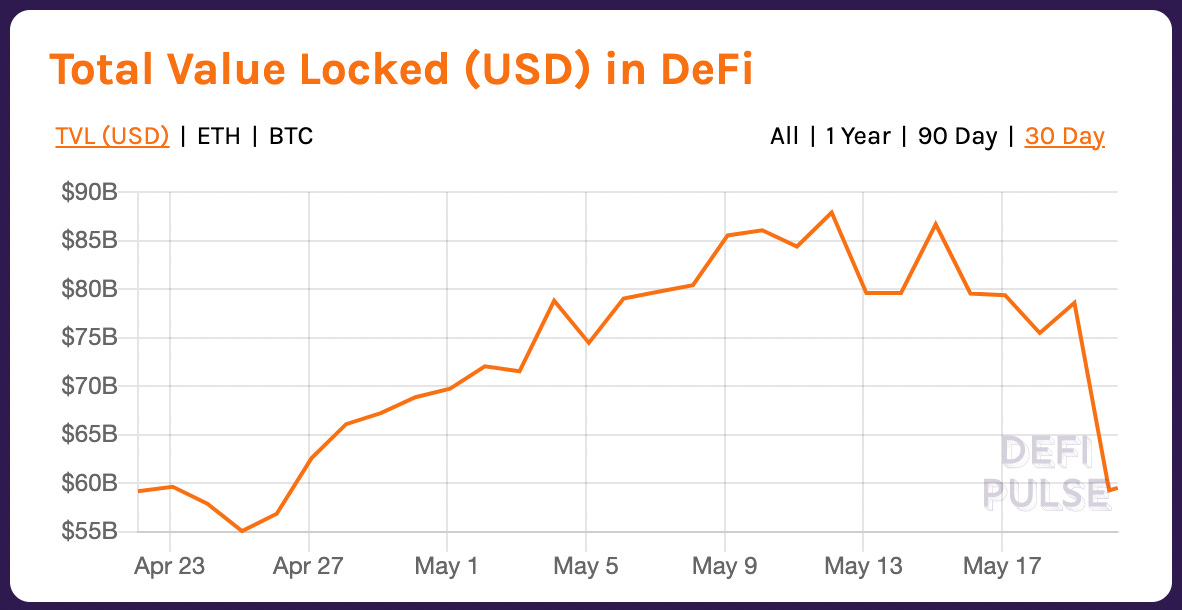

Overall, the total value locked in DeFi protocols declined from $78B to $59B. While this -25% decline is quite a large one-day move, it only brought us back to levels last seen at the end of April.

The Index Coop’s Products

Let's look at what happened to the Index Coop’s range of products.

In the recent panic, the Metaverse Index (MVI) went from $71 to $41, which is a decline of -42%. It has since recovered by +39% to $57 as of the time of this writing. The DeFi Pulse Index (DPI) declined from $601 to a low of $375, a pullback of -38%. However, it also quickly bounced back to $488, up +30% from the low.

In comparison, Bitcoin tumbled from $43k to as low as $30k (or even lower on some exchanges). That’s a -30% correction from the start of the selling, or -54% from the all-time high reached in April. The correction in Ether was just as severe, plummeting from over $3,400 to $1,800 within just a few hours, a -47% decline.

But among all of the volatility and chaos, one clear winner emerged: the leveraged product suite (FLI) from Index Coop.

This set of 2x products (ETH2x-FLI and BTC2x-FLI) provide leveraged exposure without the risk of liquidation, and this is exactly what happened. While other traders rushed to pay exorbitant gas costs to save their collateral, holders of the FLI products were able to rest assured that their funds would not be liquidated. According to CoinDesk, the recent crash triggered over 8 billion dollars in liquidations. At the same time, not a single holder of FLI products had to worry about any liquidations at all.

In addition to its promise fulfillment, the FLI products saw huge demand as people looking to buy the dip poured money into levered alternatives. This has resulted in a premium on the investment vehicles relative to NAV as demand outpaced the supply caps. This will be resolved in the next few days as IIP-42 and IIP-44 are pushed out to increase the caps.

What Comes Next?

As the storm settles down and we reexamine our crypto portfolios, there are some important lessons to keep in mind:

Diversification is Key - Concentration in just a handful of assets puts you at risk during these types of events. Diversify broadly to help minimize portfolio volatility. The easiest way to do this is to hold Index Coop products like the DPI and the MVI. More information about our products can be found here.

Be Careful With Leverage - Cascading liquidations exacerbate these types of moves. While leverage can be a quick way to glory, it can also be your downfall. If you are going to use it, consider products like the FLI suite. They offer one-click leverage with socialized gas costs and no fear of liquidation. Check out ETH2x-FLI and our newest addition BTC2x-FLI for more information.

Be Ready to Act - Crypto is notoriously volatile. Be sure you are prepared for events like this by rebalancing your portfolio frequently to stay within your personal risk tolerance. It is easier to hodl or BTFD if you are comfortable with your position sizes.

Be sure to subscribe below for future updates on all things Index Coop.